The deep liquidity of ETFs — the pace with which they can be bought and sold — comes from the markets on which They may be traded. ETFs trade on exchanges and traders can buy or market all through the investing working day, similar to shares.

Finally, ahead rates permit traders and firms to hedge against currency risk and plot potential money flows. Evaluating the spot and ahead rates permit market individuals to evaluate market expectations about long term currencies actions and strategize appropriately.

Yieldstreet isn't a bank. Particular products and services are supplied via Plaid, Orum.io and Footprint and none of these types of entities is affiliated with Yieldstreet. By using the services supplied by any of such entities you accept and settle for their respective disclosures and agreements, as relevant.

No matter if you’re aiming to build wealth, or to only help save up for your getaway, iShares ETFs can make investing as easy as selecting a playlist of music.

In fixed profits, setting up a produce curve employing facts from authorities securities or high-high quality company bonds is widespread for estimating spot rates.

In One more example, Notice that share spot costs are The existing worth of a business’s market share. By way of example, if Apple is buying and selling link at $185 for every share, that is the share’s spot price tag.

Transactions in shares of ETFs may possibly lead to brokerage commissions and may produce tax penalties. All regulated investment firms are obliged to distribute portfolio gains to shareholders.

All the small print on the forward deal to include price, settlement day, and amount of the asset to generally be exchanged are decided if the contract is made.

These rates function benchmarks, enabling traders for making swift selections when acquiring or promoting Bodily commodities or futures contracts.

The spot price may be the cash rate for swift transactions and payments in between the client and seller functions. It relates to greatly used items, which includes money markets, real-estate, and shopper products.

1050, that’s the value at which traders can exchange euros for dollars at that moment. It’s dynamic, changing right away to factors like economic news, interest rate modifications, and geopolitical developments.

Meaning that traders can infer an unidentified spot amount when they know the future’s price, if blog here the deal matures, and the risk-totally free fee.

Take into account that buying a commodity ETF isn’t similar to proudly owning the commodity. On top of that, make image source certain your ETF portfolio building makes use of principles of range and asset allocation to satisfy your targets, in lieu of concentrating much too heavily on merely purchasing one thing a bit more unique.

, this is the Trade level. It consistently variations in bps each individual 2nd. It could range at unique periods in the working day and on other days also.

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Kirk Cameron Then & Now!

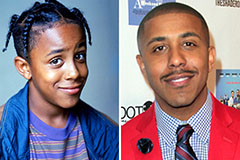

Kirk Cameron Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!